Part 4 - USE 2 PAYMENT ACCOUNTS

USE 2 PAYMENT ACCOUNTS

Back to Part 3

We have now made it to Part 4. This is when we can really start to see how we spend and track that information. This will enable us to start working on the habits we have and help us make the decisions we need to make to adjust what we do every day, but in realistic small bits.

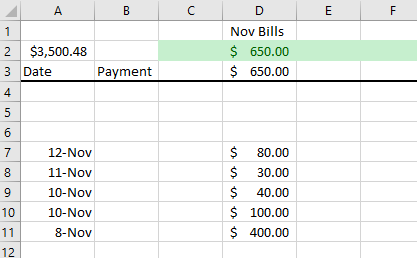

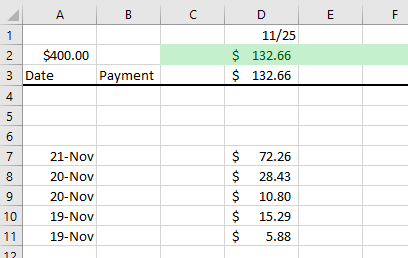

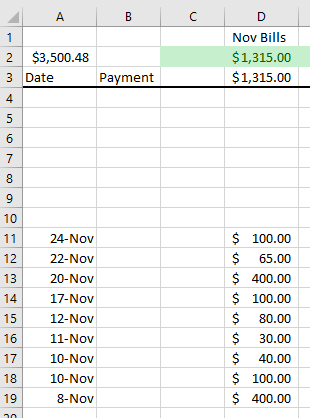

Here is where we left off last week. We have 2 different payment accounts. We now have another week that has gone by and we need to fill in our expenses from the past week.

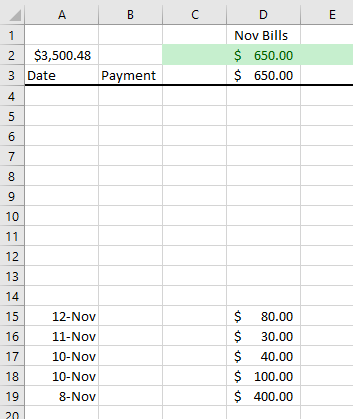

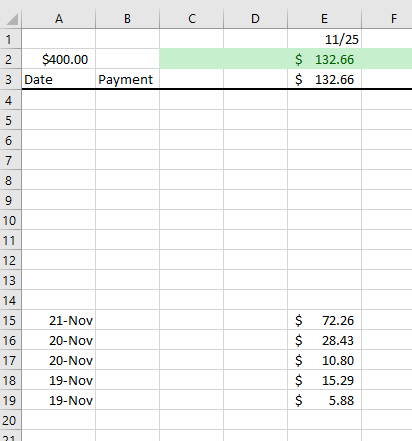

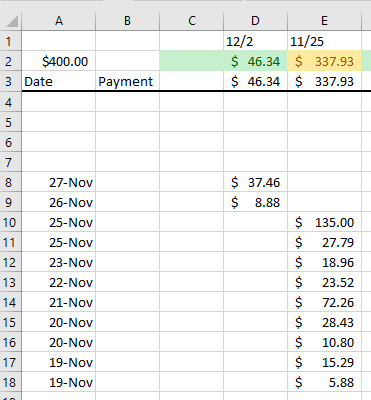

The first step is that we need to highlight a few rows and insert blank rows between Rows 6 and 7 on both worksheets. On payment account 2 we also need to add a column before column D. The resulting worksheets should look something like this:

We will now fill in our expenses with the oldest directly above the most recent entry. This is easy to do on Payment Account 1 since it is still November, but in Payment Account 2 we now need to copy cells E2 and E3 onto D2 and D3, then add the week ending date in D1 for our next week of 12/2. When we fill in our expenses, we need to add the date the expense cleared on the left and the amount in the proper column.

My sample data now looks like this:

This is all we need to do for today, but there are important items to see. 1st we can see how much we are paying so far this month on our monthly bills. We can also see that for the week ending 11/25 we spent into the yellow, but we didn’t go over our $400 / week budget target. If we did it would have turned red on row 2. This easy visualization is what gives us a simple way to see if we are on target or if we need to adjust for the next week.

IMPORTANT

This is one of the most important parts of the process. Tracking discretionary expenses week over week for a target ($400 / week in our example) is a relatively small dollar amount but gives enough time to have expenses over a time frame, but frequent enough to make changes. For example, if you were slightly over your $400 / week budget and you need to buy new clothes or shoes, you may choose to push that expense back another week. This choice will help keep your week over week average under your target but will not be the end of the world to wait 1 week before making your purchase.

Thank you

Brian