Part 6 - Maintaining 2 Credit Cards for Spending

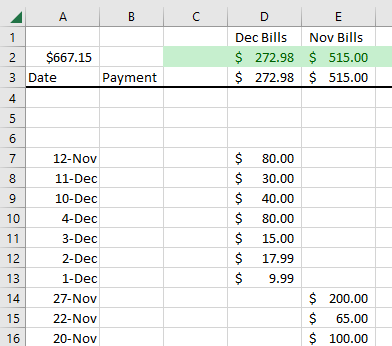

Now that we have our plan for 2 credit cards we need to use our setup to keep on top of our payments. In this week we will configure our process to make sure we pay off what we have spent. As always, I spent my Sunday morning updating my spending from the past week. This should be simple and easy to do at this point. Here are my updated worksheets:

We are tracking our spending on a weekly basis. There is no restriction to wait until you get your credit card bill before you pay the bank what you owe. My recommendation is to pay off the previous week / month as soon as that time frame is over and everything is catalogued for that time period.

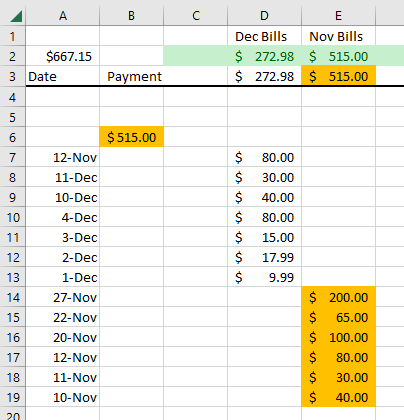

In this case we are going to start with our monthly bill. November was over a few weeks ago. So we know we need to pay the $515 for November. I will put a flag in our budget that we have scheduled the payment with our bank and I am going to highlight the payment Orange along with the total bill and each item it is paying off. In this case a picture is worth 1000 words.

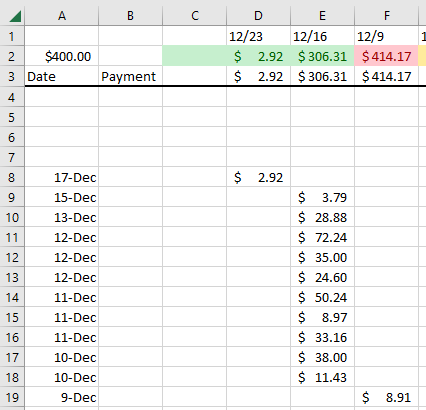

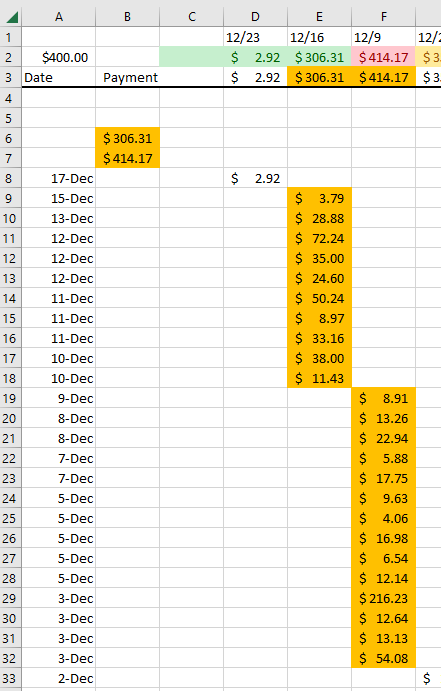

We also must pay off our weekly expenses. I am not going to go back to the beginning of our adventure, but I will go back 2 weeks. Notice I did 2 separate payments, 1 for each separate week. This will just make it easy to see visually.

I will use this orange color to easily see I have submitted the payment and know which expenses are covered by the payments. Once I see the transaction has completed with my credit card bank, then I will flag them green. This will give me comfort knowing that everything in green is completely done and I no longer need to deal with those payments, but since we just created these payments we don’t have anything to flag as green.

Next week is Christmas and then New Year’s so we will take a break until January 9th. Then we will tackle tracking our checking accounts. But just because some holidays are coming up doesn’t mean you can forget to update your tracking. See you soon.

Thank you

Brian