Part 1 - ANALYZE YOUR CURRENT SPENDING HABITS

Welcome to the first posting in this blog series. Like I have shared in the background, I previously struggled with finances. This is a step-by-step process in how I did a review of my income and expenses, and I was able to get a handle on my spending, pay off debt, and feel comfortable with my personal finances.

Part 1 is all about performing an analysis of what your current spending is before you make any adjustments. One of the biggest elements of this process is to be honest with yourself. The next part that is difficult is to have a preconceived notion that one expense is high or low. The focus is to get all the incomes and expenses defined accurately. There are many items that may come up that are planned to be covered later, let’s not get caught down the rabbit hole and focus on the primary task.

I will showcase screenshots and step by step on how I built my tracking spreadsheet at the bottom after I have explained how I got to my result.

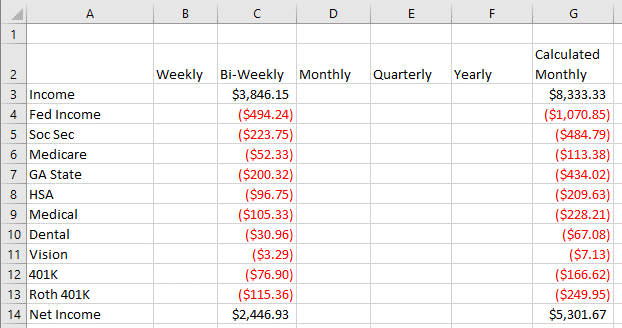

I started my analysis by looking at my income. I chose to include all the elements of my paycheck, not just my final check. If you want to go the short route, that is up to you. By including all the elements of my paycheck, it also showcases items like my medical, dental, and vision plans in addition to 401K retirement savings.

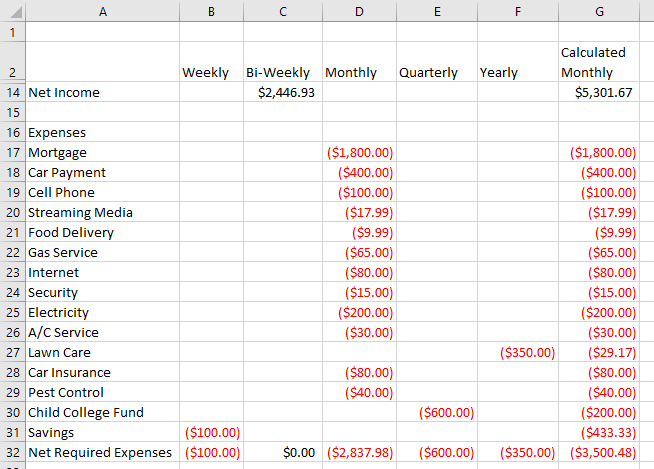

Once I completed by income, I needed to analyze my expenses. I started by splitting required expenses from discretionary expenses. To get on top of your finances, you must start by focusing on all your required expenses. Those must get paid every month; therefore, ensuring those are paid first must be a priority. I went through the last couple months and looked at which expenses were weekly, monthly, quarterly, and yearly to list out all my current expenses.

After collecting all the income and expenses, I started filling out an Excel spreadsheet with the contents. I used a few formulas to make life a little easier since not all expenses (or income) happen with the same frequency.

Once I created my Excel Spreadsheet, I listed all my income categories. Because these are elements on my paycheck, I included them all, even those that are technically expenses. I also included my net income at the bottom of this section. Feel free to add or remove categories as you need to, but if you need, ensure the formulas still cover those rows or columns.

Upon defining the chart, I needed to fill it in. If you noticed, I did put the expenses in as negative numbers. This will help with the formulas and being able to visualize it a little easier. I based this sample on 1 paycheck every other week. If your household has 2 incomes at different frequencies, please include them. You can also add elements like child support, bonuses, or other incomes that happen at different frequencies to calculate your average monthly income.

If you would like to see the formula for Cell G3, here it is:

Next, let’s insert our expenses. Each person or family’s expenses are going to look a little different. You will need to make the appropriate adjustments for yourself and your family. To make the view be easier I did hide some of the income rows in the next screenshot. I included some items that are routine expenses, but not each expense has to be the same frequency. Let Excel do the work to get an estimate of the calculated monthly expense.

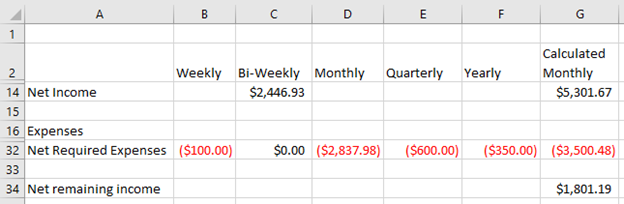

Now that I have all my income defined, and all my required expenses defined, I can calculate my remaining income to use for discretionary expenses. In this context, discretionary is used for those items that vary frequently. For example, the amount of money you pay for gas or groceries may be similar, but it could vary. The required expenses are commonly the same exact expense every cycle and is also commonly done through auto-payment methods.

That is all for Part 1. It may be daunting to get started, but the goal here is that we take 1 piece at a time, and we build a solution that works for you. Next time we will include our discretionary spending and adjust our existing spending based on need.

Please click here for the sample spreadsheet we have built. You are free to adjust for your needs.

Thank you,

Brian